In December 2018, the UK government published its Immigration White Paper which gave details of the proposed post-Brexit immigration system to be introduced after 1st January 2021.

UK Screen Alliance produced an immediate response to the White Paper and also to the review of the Shortage Occupation List. Skilled immigration is an important policy area for UK Screen Alliance members because:-

- One third of the UK’s VFX workforce is from the EEA[1]

- One fifth of the UK’s Animation workforce is from the EEA[1]

- In some successful companies the concentration of EEA workers is as high as 50%.

- The introduction of visas for skilled workers from the EEA will have a severe impact on VFX and animation companies, making them significantly less competitive in the global market.

- There is a global shortage of skilled Visual Effects (VFX) and animation workers in an industry sector that has expanded rapidly over the past 20 years

- The UK’s VFX and animation industries are highly regarded and compete successfully in a global marketplace. London is one of the world’s top creative hubs for VFX and UK based companies have won Academy Awards (Oscars) for their work.

- In terms of quality, inventiveness, technique and humour, UK animation is also world class. Our characters have become part of the national heritage, entertaining and educating generations of young people in the UK and internationally. The animation sector has huge cultural impact and it also has the potential to have significantly greater economic impact.

- Technological advances have enabled VFX to become an essential tool for filmmakers, enabling new ways of story-telling and is key to the success of many high-grossing movie titles. Computer-generated imagery makes the impossible appear possible on-screen. However, VFX is not just about creating monsters, spaceships or spectacular action sequences. There are many invisible effects created to maintain the suspension of belief for historical storylines or allowing UK filming locations to double for other parts of the world.

- Animation and VFX have a large overlap in terms of skills and job roles. It is estimated that 85% of creative roles in VFX, utilise animation skills. These same skills are also used extensively by the games industry.

- Both Animation and VFX generate significant GVA for the UK economy and attract inward investment, mainly from the USA, incentivised by the UK’s screen sector tax credits. Of the amounts claimed via the tax credits, VFX amounts to 13% of the film relief and 5.6% of the HETV relief.

- The VFX industry generated £878.2 million GVA in 2016[2] from tax credit related work but the report estimated that a total of £1.043 billion GVA[2] was generated by the industry when non-tax credit work was factored in.

The animation industry generated £163.3 million GVA in 2016[2] from tax credit related work but it is estimated that a total of £355 million GVA[2] was generated by the industry when non-tax credit work is added. - Direct employment in the VFX industry was 8,140 in 2016, but this activity supported 17,940 jobs when induced, indirect and spillover employment was factored in.[2]

Direct employment in the animation industry was 1,320 in 2016, but with the addition of induced, indirect and spillover employment this activity supported 7,120 jobs.[2] - The VFX and animation workforces have grown considerably throughout the World. It is not unusual for an individual film production to employ more 3,500 cast and crew on a single project of which more than 1,000 will be VFX workers.

- VFX and animation projects are delivered by large teams of interacting specialists. If businesses cannot access the required number of specialist workers for a particular role within those teams, the whole project workflow suffers.

- Most VFX and animation workers have degree level qualifications, although for roles relying on creativity, an impressive visual portfolio is essential and may override formal qualification at a particular level. Level 4 apprenticeships created and offered by industry, now provide a non-degree entry route into the industry for selected roles.

- The UK’s universities have been unable to keep up with demand and whilst they output reasonable numbers of UK graduates, unfortunately many do not meet the high standards required to compete at an international level. It is quality and quantity that is required. European universities and film schools are often cited by employers as producing more work-ready graduates than UK universities[3]. They require minimal on-the-job training before they can slot into teams and work at the high standards required.

- The industry is working with Higher and Further Education, embracing apprenticeships and shaping T-Levels to improve the quality of home-grown talent, but this will take time; more than 10 years. [See the considerable interventions being made by the UK’s VFX and animation sector to improve the talent pipeline.]

- The UK benefits from the knowledge transfer gained by employing globally renowned talent. Working shoulder-to-shoulder in teams lead by the world’s best, raises the UK’s skills base.

- The UK’s VFX and animation companies recruit on the basis of skill rather than nationality.

- UK workers and EEA workers in the same grades are paid the same salaries. EEA workers are not used as a source of cheap imported labour. In fact, they may be paid slightly more as Sterling is a less attractive currency to be paid in since the referendum in June 2016.

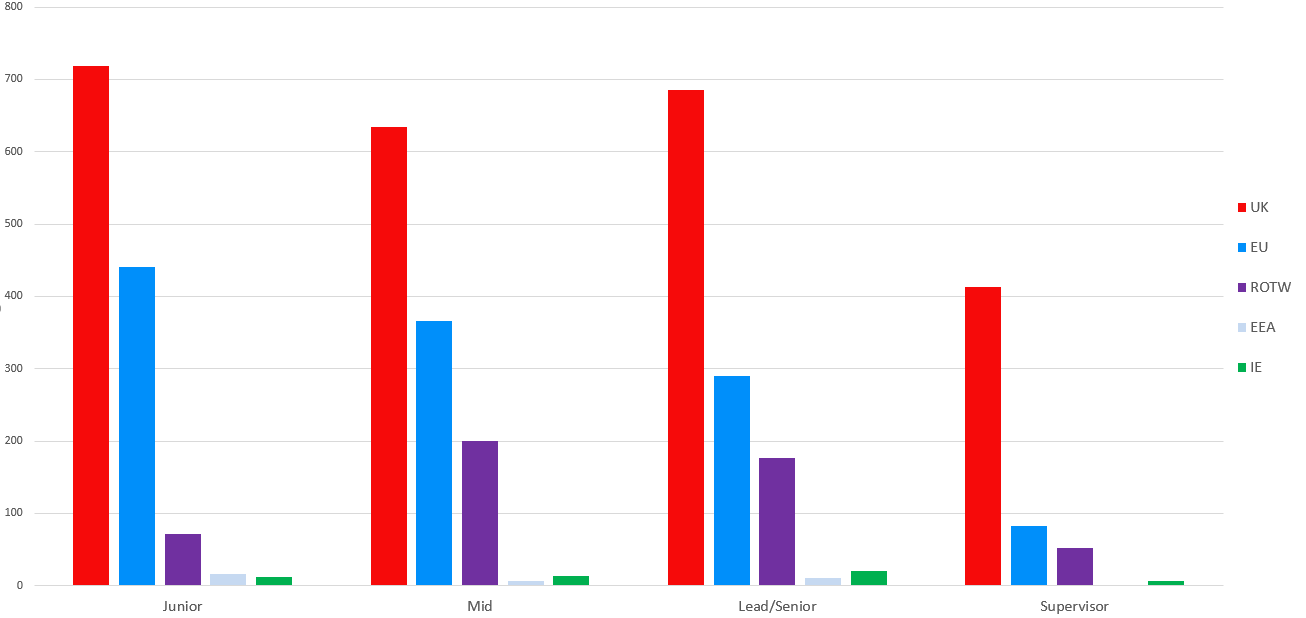

The nationality of VFX and Animation workers within seniority bands in UK Screen Alliance Workforce Survey 2018

- Significant numbers of skilled EU and EEA migrant workers can be found at all experience levels within VFX and animation companies.

- Tier 2 (General) and Tier 5 (Creative and Sporting) visas are currently used to bring in non-EEA workers at Mid, Senior and Elite levels. Visas for junior levels are not currently considered viable because of cost and these skills can be sourced currently without the cost of a visa from Europe.

- The ending of Free Movement of Labour following Brexit will raise considerable challenges to ensuring continued growth if VFX and animation businesses cannot have affordable access to the global pool of talent necessary to compete at the highest level.

- The requirement for EEA skilled workers to have visas will add significant cost. Namely, the cost of the visa, the Immigration Skills Charge, the Immigration Health Surcharge, additional overheads for administration and compliance, and the salary inflation that will be caused by minimum salary thresholds. See the next section for an analysis of the economic impact.

- There are 17 roles in VFX and animation that are on the current Shortage Occupation List (SOL). These are still in shortage and should remain on the SOL.

- It is likely that more roles will suffer shortages of suitable applicants if EEA migration is also controlled by Tier 2 visas and therefore may need to be added to the SOL.

- In a rapidly changing technological industry, roles that previously did not exist will need to be added to the SOL.

- The Immigration White Paper proposes to abolish the annual quota of 20,700 restricted visas. We welcome this proposal as it could significantly speed up the visa process, most notably by making the application process continuous and not reliant on meeting the deadline of a monthly panel to allocate restricted certificates. This of course assumes that the HM Visaa and Immigration department will sufficiently increase their resources to cope with an influx of visa applications for EEA citizens.

- The Immigration White Paper proposes to abolish the Resident Labour Market Test (RLMT) The RLMT for non-SOL roles in VFX and animation was seen as pointless delay and created significant work rejecting applications that were entirely unsuitable (many submitted merely to satisfy the applicant’s social security mandate), so we welcome this proposal.

- The Immigration White Paper neutralises the main advantages of job roles being on the SOL. Namely there will be no need for the priority given in the monthly Tier 2 allocation for SOL roles if there is no annual quota. Nor will exemption from the Resident Labour Market Test for SOL roles be an advantage if the requirement to perform an RLMT is abolished.

- Therefore, our response to the SOL Call for Evidence is made on the assumption that the SOL will remain relevant as follows:

- If the Withdrawal Agreement with the EU is voted through Parliament, we assume that the SOL will remain relevant for non-EEA immigration during the Implementation Period prior to the ending of Free Movement of Labour and the introduction of the forthcoming Immigration Bill and a new visa system.

- Tier 2 Visa application costs for roles on the SOL are lower than for other roles

- The salary threshold for applying for UK settlement (Indefinite Leave to Remain) is lower for those immigrants in Shortage Occupation List roles

- We make our own recommendations that would strengthen the relevance of the SOL

- Salary levels are a poor proxy for skill levels. A blanket minimum salary threshold of £30,000 for skilled worker visas would seriously impact sectors such as the Creative Industries, where the median salaries are lower than more highly remunerated sectors such as financial services. Setting appropriate minimum rates for roles on the SOL could allow sectoral differences to be taken into account and ensure that the visa system is based on the skills that the UK needs.However this may be overly bureaucratic, and a simpler solution would be to set an overall minimum salary requirement equivalent to the Living Wage, which would alleviate the danger of widespread post-Brexit skills shortages across many industrial sectors, not just VFX and Animation.

- It seems perverse that the Immigration Skills Charge (ISC) is levied on Tier 2 visas for roles on the SOL. Whilst the ISC was meant to collect funds to fill skills gaps, there is no evidence that the government has targeted this revenue for that purpose. There is also no evidence that the ISC has been effective in inhibiting companies from recruiting non-EEA migrants, as their number has increased since its introduction. The very fact that a role is on the Shortage Occupation List acknowledges that employment of migrant workers will be necessary to fulfil demand. To use the ISC to penalise companies for recruiting essential overseas talent is therefore counter-productive, as it syphons money away from company training budgets that could be used to develop home-grown talent. We ask that roles that are on the Shortage Occupation List are made exempt from the Immigration Skills Charge.

Economic impact of introducing visas for EEA skilled migrants in VFX and animation

Impact of the propsed £30,000 minimum salary threshold

The remuneration levels in VFX and the creative industries in general are lower than say the financial services sector. A blunt instrument like Tier 2 does not account for these sectoral differences and to apply the same threshold requirements to all skilled migration will greatly disadvantage the creative industries in securing the fresh high potential talent from the EEA necessary to deliver continued growth.

7% of the combined animation and VFX workforce are from the EEA and are remunerated below the current £30,000 Tier 2 threshold.[4]

The salary inflation necessary to remunerate these EEA workers at the Tier 2 threshold would add approximately 1% to payroll costs. We note that it will not be necessary to apply for a skilled worker visa if the EEA worker is already present in the UK and therefore the salary threshold will not apply to existing EEA workers. However, this could mean that after Brexit that new entrant workers from the EEA would need to be paid more than workers with a few years’ experience. Applying such wage increases to new EEA workers alone would very likely risk industrial unrest. Wages for all skilled workers would have to be increased to maintain parity between EEA and UK workers in similar roles and all skilled workers in pay grades immediately above £30,000 would also need to receive increased salaries to maintain pay differentials.

We estimate that the wage inflation that would be caused by a £30,000 minimum salary threshold for visas would add 3% to 5% to payroll costs, or (£11.2m to £18.62m per year on a total industry payroll of £372.3m). This will impact margins and make the UK a less competitive place in which to do business.

We disagree with the Migration Advisory Committee’s position that a high minimum salary threshold and therefore general increase wage levels encourages more UK workers to apply for the available jobs as they are perceived to be more attractive. This is a one-sided view that does not take into account the global nature of the VFX business, when companies could relecate work to territories where employment costs are cheaper. We do not see that there would be a significant increase in the employeable pool of suitably skilled UK talent if junior-level wages were to be inflated.

These escalating overheads are set against a general background of increasing employment costs in the UK. The Immigration Skills Charge was introduced on the same day as the Apprenticeship Levy[5] and workplace pension charges are increasing year-on-year.[6]

The impact of visa application costs on recruitment of EEA skilled workers

In contrast to some areas of the film and TV industry where freelancing is the norm, 43% of the VFX (Film & TV) workforce have permanent contracts with the remaining 57% having fixed term contracts ranging from a few weeks up to 2 years.[1]

It would be imprudent of any company to operate with high levels of permanent employees when the workload is subject to significant change as projects finish and new projects start. Gaps between projects are common and therefore engaging workers on fixed term contracts to match project duration is vital in order to retain overall profitability. Where possible companies extend contracts to allocate workers to new projects, but often the timing is not ideal, and it is not possible to carry the overhead of large numbers of workers who are not allocated to current revenue earning projects. This is easier to manage for larger companies where there may be as many as a dozen overlapping projects happening at any one time, some with 12 months or more lead time, which allows a greater level of predictability to workforce requirements.

Our survey suggests that 26% of the total workforce were hired within the previous year. This includes new entrants as well as crewing-up with experienced artists.

We estimate that there are around 750 new hires of EEA citizens each year in VFX and animation. This is about 34% of total annual recruitment.

Data about the intentions of existing EEA workers towards obtaining “settled” status in the UK is scarce. We acknowledge that a proportion of them will already have been domiciled or employed in the UK for at least the 5 years necessary to qualify and many more may wish to remain in the UK beyond Brexit and any transitional period, to build up the required 5 years.

It is difficult to predict how many of the yearly 750 new EEA hires in future will have “UK settled” or “pre-settled” status, although an estimate by one VFX company suggests that 60%[7] of their EEA employees may wish to apply to the settlement scheme rather than return to their country origin at the end of their contracts.

Currently we know that 32% of EEA citizens employed in VFX and animation have permanent contracts, so it is safe to assume that most of these will apply for settled status. A further 19% of EEA workers have fixed term contracts lasting longer than 1 year. In animation 21% of EEA citizens have permanent contracts.

We estimate that in 2021, 25% of our recruitment will be EEA citizens with UK settled or pre-settled status and 13% will be out-of-country EEA recruits. However, we do not expect this ratio to remain static. Every year after 2021, there will be fewer available EEA entry level recruits that are eligible for settled or pre-settled status and therefore the number of out-of-country hires will increase. It seems unlikely that a similar quality UK home-grown recruits will be available in sufficient numbers to fill the shortfall.

Since April 2017, employers recruiting non-EEA skilled workers via the Tier 2 route have had to pay the Immigration Skills Charge of £1,000 per year. The Immigration White Paper proposes that the Immigration Skills Charge should also be applied to EEA citizens using the new skilled worker visa route.

In addition, the Immigration Health Surcharge (IHS) was increased at the end of 2018 from £200 to £400 per year for visa holders. VFX and animation workers from the EEA are tax and NIC payers and therefore already contribute to the NHS, just like their UK-born colleagues The IHS is also levied on dependents so this becomes a great disincentive to experienced senior skilled migrant workers who may wish to bring their families with them.

In a worst-case scenario, applying visa charges, the immigration skills charge and the immigration health surcharge to new EEA skilled worker visas could add about £2.3 million to collective industry recruitment costs, assuming the visa applications were for the industry norm of two years with the option to extend.

[1] UK Screen Alliance workforce survey 2018

[2] BFI Screen Business report 2018

[3] UK Screen Alliance workforce survey 2017

[4] UK Screen Alliance bespoke analysis of 2018 workforce survey dataset

[5] Companies in the UK Screen Alliance workforce 2018 survey sample contribute £1.1 million per year to the Apprenticeship Levy

[6] For the 2018/19 tax year the minimum workplace pension contribution is 5% with at least 2% from the employer rising in 2019/20 to a minimum 8% with at least 3% from the employer

[7] Single anecdote from one company – may not be representative of the whole industry